The 3-Minute Rule for Paul B Insurance Medicare Advantage

Wiki Article

The Greatest Guide To Paul B Insurance Medicare Advantage

Table of ContentsGetting My Paul B Insurance Medicare Advantage To WorkExcitement About Paul B Insurance Medicare AdvantageGetting The Paul B Insurance Medicare Advantage To WorkThe smart Trick of Paul B Insurance Medicare Advantage That Nobody is Discussing10 Simple Techniques For Paul B Insurance Medicare Advantage

Medicare Benefit Plans can also supply additional advantages that Original Medicare does not cover, such as routine vision or oral care. Medicare Benefit broadens health care options for Medicare beneficiaries. Please Note: If you do not actively select and enlist in a brand-new strategy, you will remain in Original Medicare or the initial Medicare handled care strategy you presently have.This is comparable to the Medicare Benefit HMO, other than you can use companies outside of the network. The suppliers administer the plan and take the financial threat. The plan, not Medicare, sets the charge schedule for companies, however service providers can bill up to 15%more.

Paul B Insurance Medicare Advantage Can Be Fun For Anyone

These strategies may restrict enrollment to members of their organization. This is a health insurance policy with a high deductible( $3,000)combined with a cost savings account ($ 2,000). You can use the cash in your MSA to pay your medical costs( tax free). You have totally free option of service providers. The service providers have no limit on what they charge. Guaranteed Issue: The strategy needs to enroll you if you satisfy the requirements. paul b insurance medicare advantage. Care needs to be readily available 24 hr each day, seven days a week. Medical professionals should be allowed to notify you of all treatment alternatives. The plan must have a grievance and appeal treatment. If a layperson would believe that a symptom might be an emergency situation, then the strategy must spend for the first aid. The strategy can not charge more than a $50 copayment for sees to the emergency situation room. You pay any strategy premium, deductibles, or copayments. All strategies might supply extra benefits or services not covered by Medicare. There is normally less documentation for you. The Centers for Medicare and Medicaid Services (Medicare.

Not known Facts About Paul B Insurance Medicare Advantage

)pays the strategy a set amount for each month that a recipient is enrolled. The Centers for Medicare and Medicaid Providers monitors appeals and marketing plans. If you meet the list below requirements, the Medicare Advantage strategy must enlist you. You may be under 65 and you can not be denied protection due to pre-existing conditions. You have Medicare Part A and Part B.You pay the Medicare Part B premium. You reside in a county serviced by the plan. You are not getting Medicare due to end-stage kidney illness. Another type of Medicare Managed Health Upkeep Organization is a Cost Agreement HMO. These plans have different requirements for registration.The 5-Second Trick For Paul B Insurance Medicare Advantage

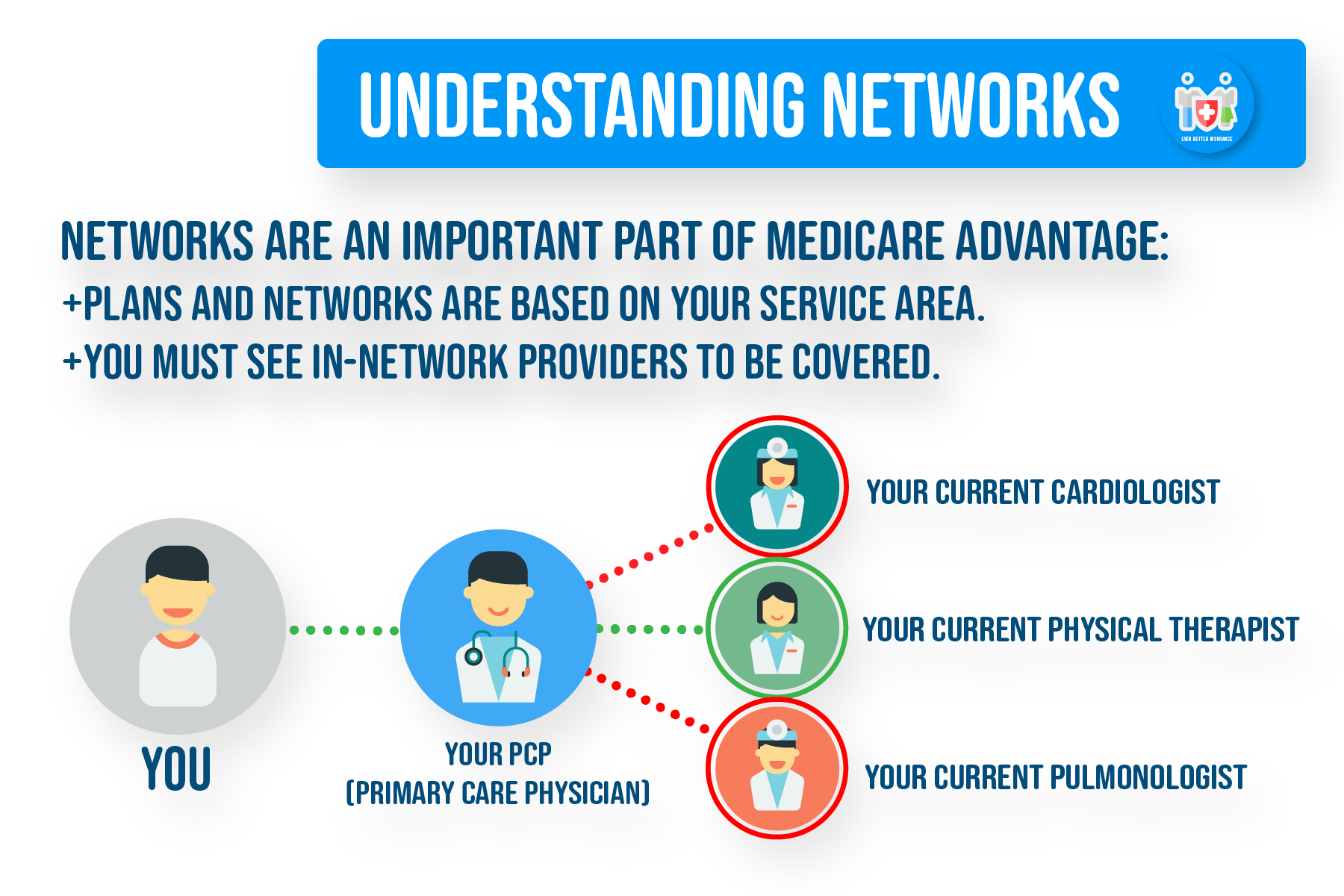

You have Medicare Part A and Part B, or only Part B.You pay the Medicare Part B premium. You live in a county serviced by the strategy. Medicare Advantage plans need to offer all Medicare covered services and are approved by Medicare. Medicare Benefit strategies may provide some services that Medicare does not normally cover, such as routine physicals and foot care, dental care, eye tests, prescriptions, hearing aids, and other preventive services. Medicare HMOs might offer some services that Medicare doesn't normally cover, such as routine physicals and foot care, oral care, eye examinations, prescriptions, hearing help, and other preventive services. You do not need a Medicare supplement policy. You have no expenses or claim types to finish. Filing and arranging of claims is done by the Medicare Benefit plan. You have 24-hour access to services, including emergency situation or urgent care with service providers beyond the network. This includes foreign travel not covered by Medicare. The Medicare Benefit plans need to enable you to appeal rejection of claims or services. If the service is still denied, then you have other appeal rights with Medicare. You should live within the service location of the Medicare Advantage strategy. If you move outside of the service location, then you must join a various plan or get a Medicare supplement policy to opt for your Original Medicare.(Exception: PPOs permit you to use suppliers outside of the network, and Medicare will still pay 80% of the authorized amount. PFFSs do not have a network of companies, however your company may not accept the strategy.)Your current medical professional or healthcare facility might not be part of the Medicare Benefit network so you would need to choose a new medical professional or medical facility. useful link A supplier could leave the see it here plan, or the strategy's agreement with Medicare could be canceled. Then, you would have to discover another Medicare Benefit plan or get a Medicare Supplement Policy to choose your Initial Medicare. If your Medical Care Doctor (PCP)leaves the strategy, then you would need to choose another PCP.If you live outside of the strategy location for 12 or more months in a row, the Medicare Advantage plan might ask you to disenroll and re-enroll when you return to the location. These protections will make it possible for beneficiaries, in specific scenarios, to try a strategy, but then return to Initial Medicare and a Medicare Supplement policy if they want to do so. Under these protections, recipients will have guarantee problem of a Medicare Supplement policy as long as they fulfill among the following criteria. To get these defenses, recipients need to use for a supplement policy within 63 days of disenrolling from the health strategy, or within 63 days of the termination of the health strategy.

Report this wiki page